mobile al sales tax rate 2019

Memorial Day Monday May 30th. California City and County Sales and Use Tax Rates Rates Effective 10012018 through 03312019 City Rate County Camino 7250 El Dorado Camp Beale 7250 Yuba Camp Connell 7250 Calaveras Camp Curry 7750 Mariposa Camp Kaweah 7750 Tulare Camp Meeker 8125 Sonoma Camp Nelson 7750 Tulare Camp Pendleton 7750 San Diego.

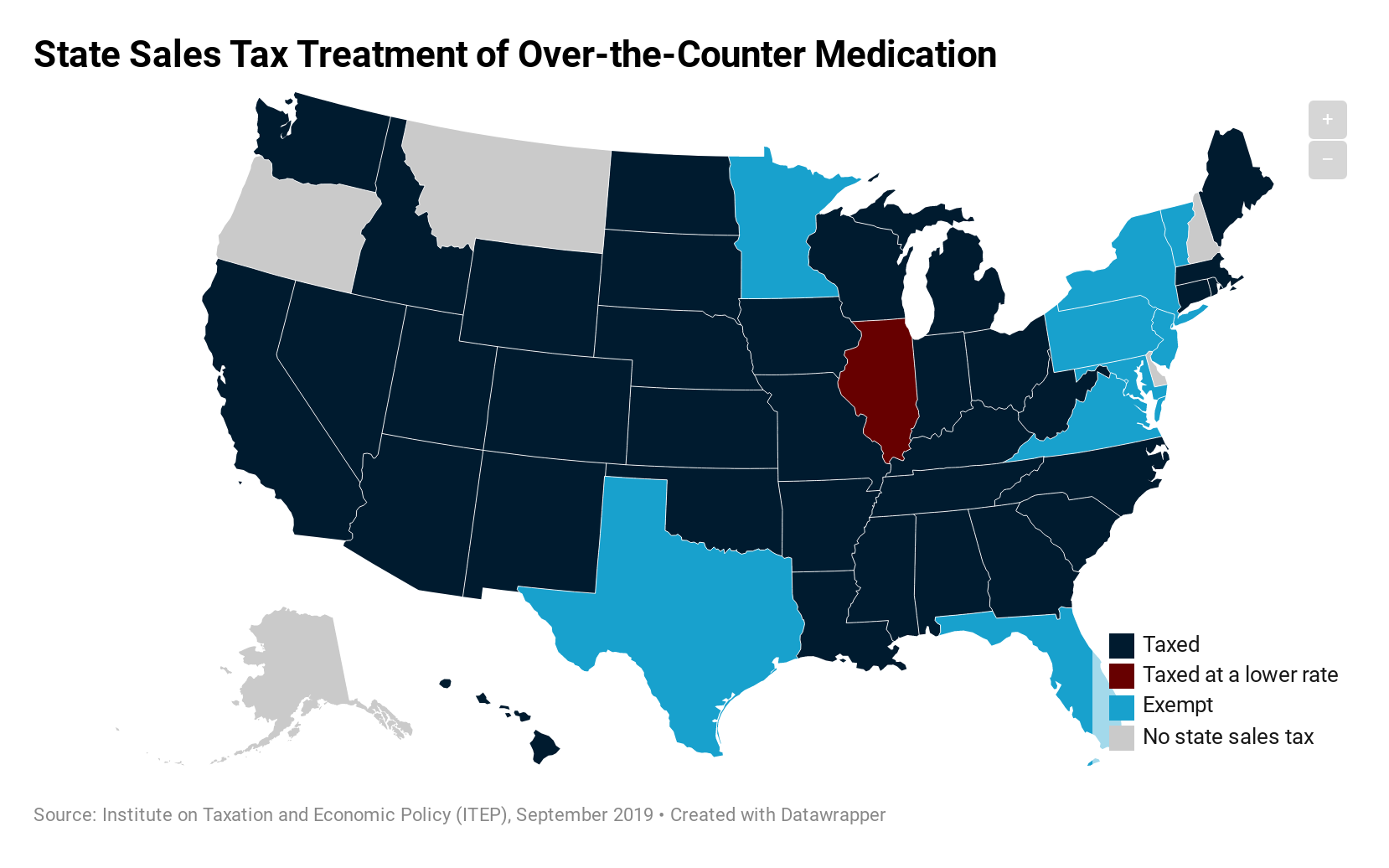

How Do State Tax Sales Of Over The Counter Medication Itep

The Mobile County sales tax rate is.

. Sales and Use Tax. The five states with the highest average combined state and local sales tax rates are Tennessee 947 percent Louisiana 945 percent Arkansas 943 percent Washington 917 percent and Alabama 914 percent. Average Sales Tax With Local.

Mobile Al Sales Tax Rate 2019. 150 rows The Food Service Establishment Tax is an additional one percent 1 sales tax levied on the gross proceeds of sales at retail of food andor beverages sold for consumption. 4 rows Rate.

Cfs Tax Software Order Form. No state rates have changed since July 2018 when Louisianas declined from 50 to 445 percent. NOTICE TO PROPERTY OWNERS and OCCUPANTS.

The Tax Foundation found that Alabama has the nations fifth highest average combined state and local sales tax rates at 914 percent. That ranks behind Tennessee 947. Of Montpelier 0 and Burlington 1 Avg.

The Mobile Alabama sales tax is 1000 consisting of 400 Alabama state sales tax and 600 Mobile local sales taxesThe local sales tax consists of a 150 county sales tax and a 500 city sales tax. Alabama Legislative Act 2010-268. January 2 2019.

Are Dental Implants Tax Deductible In Ireland. Next to city indicates incorporated city City Rate County Avalon 10000 Los Angeles Avenal 7250 Kings Avery 7250 Calaveras Avila Beach 7250 San Luis Obispo Azusa 9500 Los Angeles. Aroma Indian Restaurant West Palm Beach.

This tax is in addition to the 5 general sales tax levy. There is no applicable special tax. This is the total of state and county sales tax rates.

Mobile collects a 6 local sales tax the maximum local sales tax allowed under. The Alabama state sales tax rate is currently. California City and County Sales and Use Tax Rates Rates Effective 07012019 through 12312019 2 P a g e Note.

In accordance with Alabama Law Section 40-7-74 and Section 40-2-11 please be advised that a member of the Mobile County Appraisal Staff may visit your property to review or update. Mobile Al Sales Tax Rate 2019. Opry Mills Breakfast Restaurants.

PLEASE REMEMBER THAT ALL LOCATIONS ARE CLOSED ON WEDNESDAYS. Has impacted many state nexus laws and sales tax collection requirements. The 10 sales tax rate in Citronelle consists of 4 Alabama state sales tax 15 Mobile County sales tax and 45 Citronelle tax.

Sales and Use taxes have replaced the decades old Gross Receipts tax. Simplified Sellers Use Tax Rate 40-23-193a. 1 lower than the maximum sales tax in AL.

Alabama has a 4 sales tax and Mobile County collects an additional 15 so the minimum sales tax rate in Mobile County is 55 not including any city or special district taxes. By Jan 19 2021 G2 OpenBook 0 comments Jan 19 2021 G2 OpenBook 0 comments. The rate type is noted as Restaurant in MAT and as REST in the ADOR local rates.

Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23fee 150 minimum for each registration year renewed as well as 100. Restaurants In Erie County Lawsuit. 2022 List of Alabama Local Sales Tax Rates.

You can print a 10 sales tax table here. The minimum combined 2022 sales tax rate for Mobile County Alabama is. Mobile al sales tax rate 2019.

The 2018 United States Supreme Court decision in South Dakota v. For sales made or delivered outside the corporate limits of the city but within the police jurisdiction the rate of tax is 15. Lowest sales tax 5 Highest sales tax 115 Alabama Sales Tax.

The 10 sales tax rate in Mobile consists of 4 Alabama state sales tax 1 Mobile County sales tax and 5 Mobile tax. No small business owner likes taxes and Alabama has some of the nations highest when it comes to its average combined state and local tax rates according to a new report. You can print a 10 sales tax table here.

On April 1 2019 the general sales and use tax rate and the sales and use tax rate for admissions to places of amusement and entertainment will jump from 2 to 3 in the city of Evergreen Alabama. Restaurants In Matthews Nc That Deliver. Section 34-22 Provisions of state sales tax statutes applicable to article states The taxes levied by this article shall be subject to all definitions.

For tax rates in other cities see Alabama sales taxes by city and county. City Ordinance 34-033 passed by the City Council on June 24 2003 went into effect October 1 2003. Tax Collector Near Me Brandon.

Learn more about sales and use tax in Alabama. Majestic Life Church Service Times. The Mobile Sales Tax is collected by the merchant on all qualifying sales made within Mobile.

Alabama has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 7. Feeling Lost In Life At 50. Monday Tuesday Thursday Friday.

Best Restaurants In Downtown Mobile Al. There is no applicable special tax. 24 rows sales tax.

For tax rates in other cities see Alabama sales taxes by city and county.

Alabama Sales Tax Rates By City County 2022

Sales Tax On Grocery Items Taxjar

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

6 Differences Between Vat And Us Sales Tax

/cdn.vox-cdn.com/uploads/chorus_asset/file/13673574/3.png)

How Marginal Tax Rates Actually Work Explained With A Cartoon Vox

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

.png)

States Sales Taxes On Software Tax Foundation

Mobile Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Screenshot Of Excel 2013 Excel Formula Excel Reference

Sales And Use Tax Rates Houston Org

How Do State And Local Sales Taxes Work Tax Policy Center

State Corporate Income Tax Rates And Brackets Tax Foundation

States With Highest And Lowest Sales Tax Rates

The Dual Tax Burden Of S Corporations Tax Foundation

Mobile Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders