south dakota sales tax calculator

54 rows Free calculator to find the sales tax amountrate before tax price and after-tax price. Aberdeen is in the.

Free Llc Tax Calculator How To File Llc Taxes Embroker

Furthermore taxpayers in South Dakota do not need to file a state tax return.

. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 523 in South Dakota. So whilst the Sales Tax Rate in South Dakota is 4 you can actually pay anywhere between 45 and 65 depending on the local sales tax rate applied in the municipality. Maximum Possible Sales Tax.

Average Local State Sales Tax. If this rate has been updated locally please contact us and we will update the sales tax rate for Lennox. Average DMV fees in South Dakota on a new-car purchase add up to 48 1 which includes the title registration and plate fees shown above.

Sales tax in Lennox South Dakota is currently 65. South Dakota Documentation Fees. This makes South Dakota a generally tax-friendly state.

The average cumulative sales tax rate in the state of South Dakota is 523. Click Search for Tax Rate. Sales Tax Table For South Dakota.

Where you need to register. Other local-level tax rates in the state of South Dakota are quite complex compared against local-level tax rates in other states. Depending on local municipalities the total tax rate can be as high as 65.

Identify and apply for business licenses. Maximum Local Sales Tax. Apply more accurate rates to sales tax returns.

Enter the Amount you want to enquire about. If 1000 worth of goods are purchased in a jurisdiction with a 5 sales tax rate no use tax is owed to South Dakota because the foreign jurisdictions sales tax rate is greater. 31 rows The latest sales tax rates for cities in South Dakota SD state.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. 31 rows South Dakota SD Sales Tax Rates by City. To know what the current sales tax rate applies in your state ie.

For more information on excise taxes related to construction projects consult the South Dakota Department of Revenues site as of this writing excise taxes stand at 2 on gross receipts. If 100 worth of books is purchased from an online retailer and no sales tax is collected the buyer would become liable to pay South Dakota a total of 100 4 400 in use tax. There also arent any local income taxes.

The sales tax rate for Lennox was updated for the 2020 tax year this is the current sales tax rate we are using in the Lennox South Dakota Sales Tax Comparison Calculator for 202223. Wood is located within Mellette County South DakotaWithin Wood there is 1 zip code with the most populous zip code being 57585The sales tax rate does not vary based on zip code. Quickly learn licenses that your business needs and let Avalara manage your license portfolio.

The municipal gross receipts tax can be imposed on alcoholic beverages eating establishments. Sales Tax Rate s c l sr. Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc.

All numbers are rounded in the normal fashion. This makes South Dakota a generally tax-friendly. South Dakota all you need is the simple calculator given above.

The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any. This includes the rates on the state county city and special levels. Searching for a sales tax rates based on zip codes alone will not work.

Please select a specific location in South Dakota from the list below for specific South Dakota Sales Tax Rates for each location in 2022 or. Find your South Dakota combined state and local tax rate. Rates include state county and city taxes.

Average Local State Sales Tax. Municipalities may impose a general municipal sales tax rate of up to 2. Specialty builders in the State of South Dakota are required to have a contractors excise tax license are responsible for paying sales or use tax on all construction materials and are responsible for remitting the 2 contractors excise tax at the time of closing if sold within four years of completion.

South Dakota sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. 2020 rates included for use while preparing your income tax deduction. As mentioned above South Dakota does not have a state income tax.

South Dakota has a 45 statewide sales tax rate but also has 290 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1817 on. In addition cities in South Dakota have the option of collecting a local sales tax of up to 3. South Dakota Sales Tax.

Cities may impose municipal sales and use tax of up to 2 and a 1. Choose the Sales Tax Rate from the drop-down list. Sales tax data for South Dakota was collected from here.

It also has one of the lowest sales taxes in the nation with a base sales tax rate of just 45 though m unicipalities may impose a general. The South Dakota Department of Revenue administers these taxes. The current total local sales tax rate in Aberdeen SD is.

Sales taxes are much more important in the south and west than they are in New England and the industrial Midwest. Marketplace providers are required to remit. South Dakota Sales Tax.

Put your rates to work by trying Avalara Returns for Small Business at no cost for up to 60 days. The average cumulative sales tax rate in Wood South Dakota is 45. Enter a street address and zip code or street address and city name into the provided spaces.

South Dakotas state sales tax rate is 450. The state sales tax rate for South Dakota is 45. Local tax rates in South Dakota range from 0 to 2 making the sales tax range in South Dakota 45 to 65.

The State of South Dakota relies heavily upon tax revenues to help provide vital public services from public safety and transportation to health care and education for our citizens. Municipalities may impose a general municipal sales tax rate of up to 2. Most major cities only.

For cities that have multiple zip codes you must enter or select the correct zip code for the address you are supplying. US Sales Tax Rates SD Rates Sales Tax Calculator Sales Tax Table. To calculate the sales tax amount for all other values use our sales tax calculator above.

The South Dakota SD state sales tax rate is currently 45. Sales Tax Calculator Sales Tax Table. South Dakota State Sales Tax.

Sales Use Tax. They may also impose a 1 municipal gross receipts tax MGRT that is in addition to the municipal sales tax. Just enter the five-digit zip code of the.

Simplify your sales tax registration. Thats where you need a Sales Tax Calculator like ours which will keep you at ease fully satisfied. Aberdeen Details Aberdeen SD is in Brown County.

Most services in South Dakota are subject to sales tax with some exceptions in the construction industry.

Kansas Tax Rates Rankings Kansas State Taxes Tax Foundation

South Dakota Alcohol Taxes Liquor Wine And Beer Taxes For 2022

Capital Gains Tax Calculator 2022 Casaplorer

How To Register For A Sales Tax Permit Taxjar

Calculate The Sales Taxes In The Usa For 2022 Credit Finance

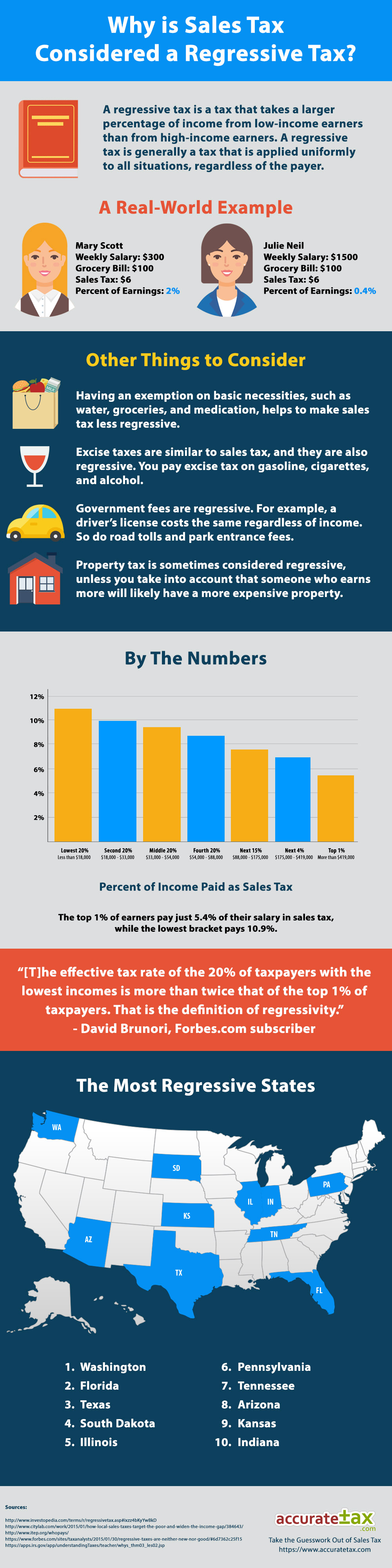

Why Is Sales Tax Considered Regressive Sales Tax Infographic

4 Reasons A Transaction May Be Exempt From South Dakota Sales Tax South Dakota Department Of Revenue

South Dakota Alcohol Taxes Liquor Wine And Beer Taxes For 2022

District Of Columbia Sales Tax Small Business Guide Truic

Kansas Tax Rates Rankings Kansas State Taxes Tax Foundation

Income Tax Calculator 2021 2022 Estimate Return Refund

How To Get A North Dakota Sales Amp Use Tax Permit North Dakota Sales Tax Handbook

What S The Car Sales Tax In Each State Find The Best Car Price

What Is Sales Tax Nexus Learn All About Nexus

Vape E Cig Tax By State For 2022 Current Rates In Your State

Kansas Tax Rates Rankings Kansas State Taxes Tax Foundation

How To Register For A Sales Tax Permit Taxjar

The Johnson County Kansas Local Sales Tax Rate Is A Minimum Of 7 975